24th June 2015 issued by EPF department Deposit of EPF Contributions through Internet Online Banking is not mandatory for those employers who are remitting contribution below Rs. Employers are required to deposit dues.

As noted by Honble Supreme Court an.

. 1 lakh per month with till 30092015 and it will be mandatory to pay online from 01102015. 15 interest per year for a delay of 4-6 months. And the employer does not need to deduct the employees contribution from those payments That being said what constitutes as wages may not be straightforward in all cases.

The EPFO has a provision of charging damages or penalty from the employers who are unable to deposit PF contributions as mandated under the EPF Scheme 1952. Also the credited amount to a members account cannot be attached against any liability as the Provident Fund enjoys. Service charge Overtime Gratuity Retirement benefit Retrenchment temporary lay.

There have been examples where employers would deduct an employees EPF contributions but not make any payments to the employees account. However effective from April 1 2020 onwards employers contribution to the EPF account can become taxable if it exceeds Rs 75 lakh in a financial year. ET PRIME - PERSONAL FINANCE STORIES.

Increase in Age limit to withdraw 90 of PF balance. You are not on permanent rolls and the employer is not liable to. However there are a number of payment types that will not be subject to EPF deductions.

Full EPF balance cannot be withdrawn before attaining the new Retirement Age of 58 years. If youre an employee who is above the age of 60 you generally dont have to contribute to your EPF but your employer MUST contribute 4 of your salary regardless of how much your salary is. OPEN APP Home News India Employer must pay damages for delay in payment of EPF contribution rules SC Employer must pay damages for delay in payment of EPF contribution rules SC The Supreme.

The employer does not need to make employer contributions to the EPF. If the employer is found guilty of it they can be jailed or up to 6 years andor fined up to RM20000 under Section 48 3 of the EPF Act 1991. Continuity of EPF membership.

Amount credited to the member can be attached against any liability. What payments are not liable for EPF contributions then. Among the payments not liable for EPF contribution.

It is important to know this important rule which gives you a right to claim your EPFO from the company you are working with. Partial withdrawal of EPF amount on Resignation. Payments that are liable for EPF contributions According to Section 431 of the EPF Act 1991 every employee and every employer must make monthly contributions to the EPF.

Under the new notification No. We are of the considered view that any default or delay in the payment of epf contribution by the employer under the act is a sine qua non for the imposition of levy of damages under section 14b of the act 1952 and mens rea or actus reus is not an essential element for imposing penaltydamages for breach of civil obligationsliabilities the. 5 interest per year for delays of up to 2 months.

We are of the considered view that any default or delay in the payment of epf contribution by the employer under the act is a sine qua non for the imposition of levy of damages under section 14b of the act 1952 and mens rea or actus reus is not an essential element for imposing penaltydamages for breach of civil obligationsliabilities the. Service charges Overtime payment Gratuity Retirement benefits Retrenchment temporary and lay-off termination benefits Any travelling allowance or the value of any travelling concession Payment in lieu of notice of termination of employment Directors fee Who Are Obligated to Contribute. Access to internet banking makes EPF contribution payments much easier now.

The payments below are not considered wages by the EPF and are not subject to EPF deduction. 12 - How a member is informed about the non-payment of contributions recovered from the wages of the employee but not paid to the EPF. Much of this depends on the construction of section 2 of the EPF Act which defines the word wages.

These are covered by the EPF Act 1991 and have also been listed out on the official EPF website. Among the payments that are exempted from EPF contribution. These latest EPF withdrawal rules are effective from 10 February 2016.

Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the Third Schedule. Regional Provident Fund Commissioner and ors 2015 LLR 1023 the Punjab Haryana High Court has held that so long so the code number is not allotted to the contractor it is the liability of the establishment to pay the provident fund on account of the employees employed by the contractor and thus in essence it is the liability of. 13 - Whether the PF.

As before insertion of Explanation 2 to Section 361va of the Act there is ambiguity regarding due date of payment of employees contribution on account of provident fund and ESI whether the due date is as per the respective acts or up to the due date of filing of return of income of the assessee. As per current law an employees own contribution to the EPF account is not taxable. Amendments are related to.

Your employer will have to pay contributions towards EPFO accounts in priority over his other debts. What if your employer hasnt been paying your EPF. In Calcutta Constructions Company vs.

The employer would also be liable to pay late payment charges. Bkg1 42010Online Remittance 12871 Date. Statutory epf contribution should be.

The employer is liable to pay monthly contributions within 15 days of the following month. Service charges Overtime payments Gratuity payments Retirement benefits. As an independent establishment it is responsible for payment of EPF contributions and other dues payable under Provident Fund Act the principal employer cannot be asked by the Provident Fund Authorities in case a contractor holding independent code number defaults the Provident Fund dues.

We are of the considered view that any default or delay in the payment of epf contribution by the employer under the act is a sine qua non for the imposition of levy of damages under section 14b.

Myfreelys Academy Kwsp Definition Of Wages For Epf Purpose All Remuneration In Money Due To An Employee Under His Contract Of Service Or Apprenticeship Whether It Was Agreed To Be Paid

Epf And Directors Duties Are Sleeping Directors Liable Donovan Ho

Eligibility Criteria For Epf Withdrawal And Tax On Epf Withdrawal

Employer Obligated To Pay Damages For Delay In Payment Of Epf Contribution Sc

Epf Scheme How To Check Epf Claim Status Ebizfiling

10 Hidden Epf Rules Which Will Blow Your Mind

Check Epf Balance In 4 Easy Steps Online Infographic Balance Sms

Interest On Epf Contribution Above Rs 2 5 Lakh To Be Taxable What It Means For You Businesstoday

What Is Epf Deduction Percentage Quora

A Complete Guide On Process For Epf Withdrawal Online Claim Ebizfiling

Epfo On Twitter Epfo Launches Electronic Facility For Principal Employers To View Epf Compliances Of Their Contractors Epfo Socialsecurity Humhainna Https T Co Pdyziwm5pf Twitter

Epf Contribution Reduced From 12 To 10 For Three Months

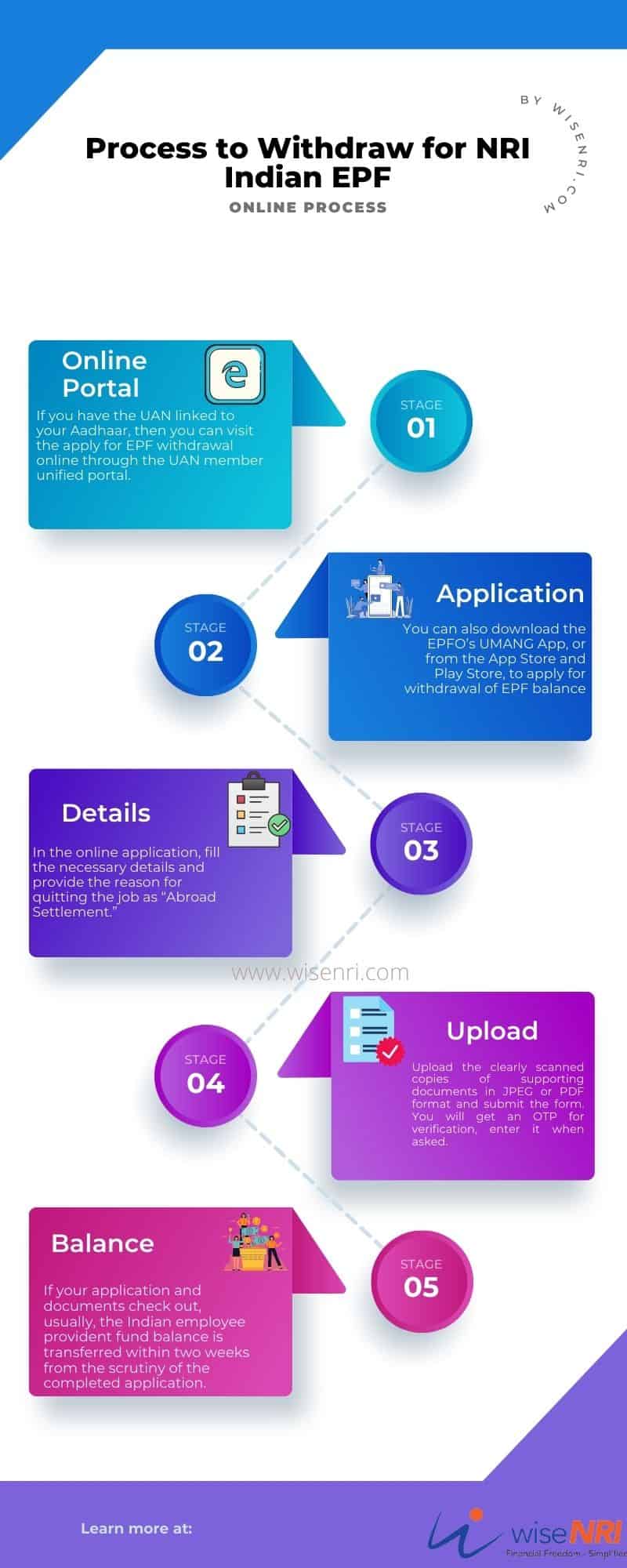

What Should Budding Nris Do With Their Indian Epf Accounts

Tax On Epf Withdrawal Rule Flow Chart Personal Finance Tax

Employees Provident Fund Epf Eps Edli Its Calculation Ceiling Limit Fund General Partnership Employee

If Employer And Employee Agree There S No Bar In Epf Enrolment Mint

Employer Must Pay Damages For Delay In Payment Of Epf Contribution Rules Sc Mint